Business Finance Foundations

Be ready to advance your knowledge of Business Finance with this free online course. Learn about the role of the Finance Manager through various examples that will make it easy for you to understand the concepts well.

What you learn in Business Finance Foundations ?

About this Free Certificate Course

This Business Finance Foundations course is a 2.5-hour course that begins with an overview of Business Finance. This online business finance course will further introduce learners to different accounting and business finance concepts. These concepts will be explained with the help of examples taken from the real financial statements of companies so that it remains practical learning for the students. Get access to reference materials to help you better comprehend financial statements such as balance sheets, cash flow statements, and profit and loss statements. The course progress will be evaluated using a quiz at the end of each module.

Do you wish to take your career in Finance ahead? Enroll in our Executive Management course that lets you choose a Finance specialization and advance your career through cutting-edge skills in finance.

Course Outline

Learn the basic responsibilities of a finance manager. This session will walk you through the financial decisions that must be made in order for a firm to run smoothly.

In this session, you will become familiar with accounting and its various terms from different perspectives.

Understand Accounting and its users in detail. The session will also walk you through the requirements that must be observed when recording transactions in financial statements.

Understand accounting transactions with a variety of examples in this session. Find out how these transactions will be documented as well.

The session will explain what a balance sheet is and how it works. After you've mastered the fundamentals, you'll be guided through Tata Steel Limited's Balance Sheet to help you grasp the concept. This session will be completely focused on the Asset side of the Balance Sheet.

With this course, you get

Free lifetime access

Learn anytime, anywhere

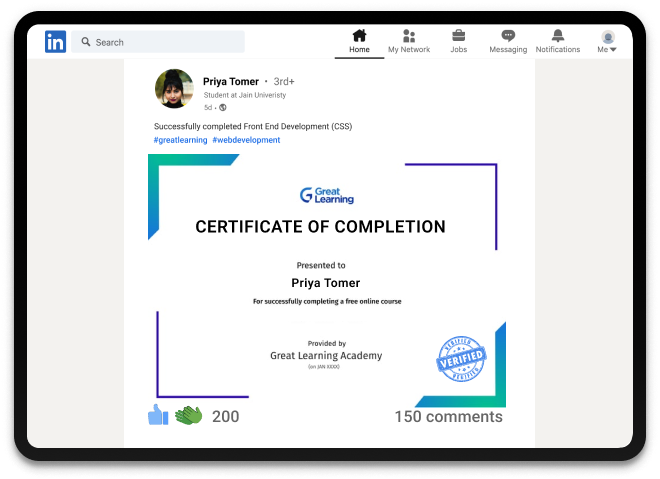

Completion Certificate

Stand out to your professional network

2.5 Hours

of self-paced video lectures

Frequently Asked Questions

What are the prerequisites required to learn a Business Finance Foundations course?

To take the Business Finance Foundations course, you need to have an interest in learning finance. This is a beginner course and even a person with no knowledge about business finance can take up this course.

How long does it take to complete this free Business Finance Foundations course?

This free Business Finance Foundations course contains 2.5 hours of video content and a quiz. It's on you how much time you want to take to complete the course. In one go, the course should not take more than 3-4 hours.

Will I have lifetime access to the free Business Finance Foundations course?

Yes. The learners once enrolled in the free Business Finance Foundations course, will get lifetime access to it.

What are my next learning options after this Business Finance Foundations course?

After completing this Business Finance Foundations course, the learners can opt for Management courses to discover various career options. The Executive PG Program in Management is the best option for the learners as it provides a finance specialization that can strengthen the finance skills and knowledge and can help you advance your career in the field.

Is it worth learning Business Finance Foundations?

Yes. It is worth doing a Business Finance course because understanding finance can help you a lot professionally. You can:

- Analyze the financial health of your business

- Interact better with your company's finance source

- Understand the capital markets and investments

- Know what future actions can be taken

Success stories

Can Great Learning Academy courses help your career? Our learners tell us how.And thousands more such success stories..

Related Management Courses

Popular Upskilling Programs

Explore new and trending free online courses

Relevant Career Paths >

Business Finance Course

Business finance refers to the management of a company's financial resources and how those resources are used to achieve the company's goals. It encompasses a wide range of topics and covers the following aspects:

Financial Planning and Budgeting: Financial planning and budgeting are important components of business finance. Financial planning involves setting financial goals, such as revenue and profitability targets, and developing a plan to achieve those goals. Budgeting involves creating a plan for allocating financial resources to various business activities, such as marketing, research and development, and operational expenses. Monitoring the company's financial performance is also crucial in order to ensure that the business is on track to achieve its financial goals.

Capital Budgeting: The process of choosing to invest in long-term assets, such as machinery, real estate, or research and development, is referred to as capital budgeting. Capital budgeting decisions involve analyzing the costs and benefits of each potential investment and determining which investments are most likely to generate a positive return.

Financial Statements: Financial statements provide insights into a company's financial health by summarizing its financial activities. The balance sheet, income statement, and cash flow statement are the three most important financial statements. The balance sheet gives a detailed picture of the company's assets, liabilities, and equity at a particular time. The income statement shows the company's revenue and expenses over a given period of time, and the cash flow statement shows the company's cash inflows and outflows during the same period.

Cost of Capital: The term "cost of capital" refers to the price paid for the money used to finance a business's operations, including the price paid for borrowing money with debt or equity or from other sources. It is important to understand the cost of capital in order to make informed decisions about how to finance the company's operations.

Working capital management: It is a term used to describe how a company manages its daily financial resources, such as cash flow, inventory, and accounts receivable. It is important to manage these resources effectively in order to ensure the company has enough liquidity to meet its short-term obligations.

Debt Management: Debt management involves managing a company's debt, including determining the appropriate amount of debt to take on, managing interest payments, and reducing debt when necessary. Striking a balance between taking on debt to finance growth and avoiding excessive debt that could harm the company's financial health is crucial.

Corporate Finance: Corporate finance involves making decisions about how to finance a company's operations, including issuing bonds, equity, and other financial instruments. Corporate finance decisions impact a company's cost of capital and its ability to access financing for growth and expansion.

Risk Management: Risk management involves identifying, assessing, and mitigating potential financial risks, such as market volatility, interest rate fluctuations, and currency risk. It is important to manage financial risks in order to minimize the potential impact of adverse events on the company's financial performance.

Investment Management: Investment management involves managing a company's investment portfolio, including managing stocks, bonds, and other financial instruments. Investment management decisions can impact a company's financial performance and its ability to generate additional revenue through investments.

Financial Markets: Understanding the financial markets, including the stock market, bond market, and commodities market, is important in order to make informed investment decisions and understand how market conditions may impact a company's financial performance.

These are some of the most crucial elements of business finance in detail, and managing a company's financial resources successfully requires a solid grasp of each of these subjects.

.jpg)